2025 Top 50 Trenchless Engineering Firms in North America Survey Results

The November/December issue regularly focuses on trenchless engineering. The issue examines innovative projects and explores design trends in underground pipeline installation and rehabilitation. The centerpiece of this coverage is our 2025 Top 50 Trenchless Engineering Firms survey.

Examining the results of the Top 50 survey can offer some insights into the state of the industry. It also offers a look at the innovative methodologies that owners adopt.

“Clients are asking for less disruption to the public and longer length drives to deal with environmental constraints such as protected areas,” says Andrew Finney. Finney is vice president and global principal lead for trenchless at Jacobs, which ranks No. 1 on this year’s survey. “Sewers are getting their manholes spaced further apart, so that also means longer drives.”

Finney highlights the City of Calgary’s Nose Creek Sanitary Sewer Trunk project. It broke the record for the longest single microtunneling drive completed in North America. The project comprised a single drive of 1.5 km performed by Ward & Burke Microtunnelling Ltd. It features four horizontal curves ranging from 700-m to 1,750-m radius, as well as a vertical curve.

“Contractors are really starting to take a look at the tools they already have. And looking for innovative ways to use them,” adds Finney. “Engineers get to leverage some of their bold moves.”

“We’re also seeing a lot of directional drilling for data centers. It’s a big deal – water infrastructure and using water for cooling. That comes with a lot of trenchless installations, as well.”

2025 Top 50 Trenchless Engineering Firms

This year marks the 30th entry of Trenchless Technology’s Top 50 Trenchless Engineering Firms. We compile the Top 50 ranking from revenue and project data submitted by engineering companies via a survey.

Only revenue figures submitted to Trenchless Technology were used to compile this ranking. As always, Trenchless Technology would like to thank all participating engineering firms for their thorough review of these figures and for working with our staff to make sure the information submitted is accurate and consistent parameters have been followed.

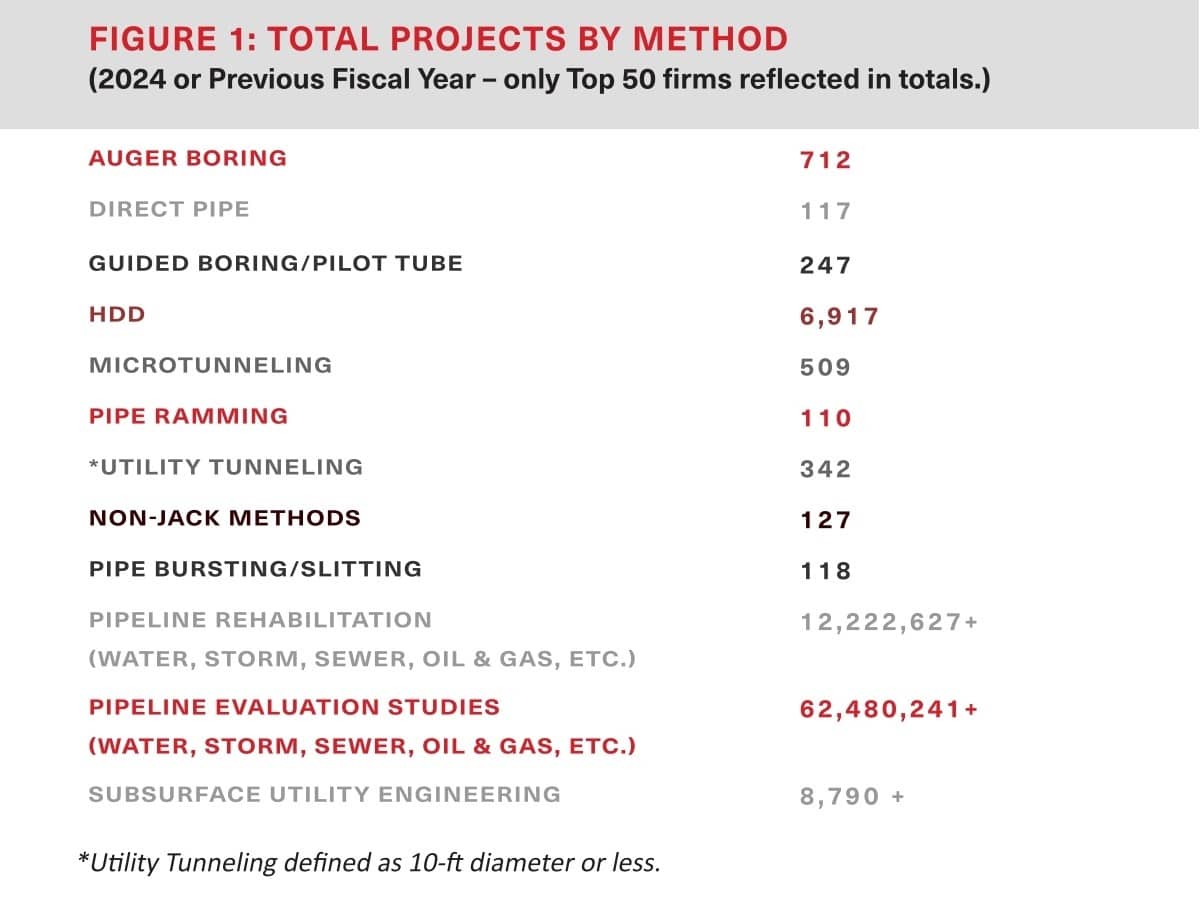

The Top 50 are ranked by North American trenchless revenue in 2024 or the company’s last fiscal year. This is shown in the third column: 2024 NA Trenchless Net. Specific revenue figures are shown for trenchless work in the United States and Canada. This is in the first two columns of the ranking. All figures are in U.S. dollars. Trenchless revenue on the survey is defined as the net revenue generated by a firm from trenchless professional services. This includes design, construction oversight and inspection using the new installation or rehabilitation methods. (Figure 1)

By the Numbers

In this year’s results, Jacobs vaults to the top spot, ranking No. 1. Jacobs reports more than $333 million in trenchless revenue. Jacobs also retains No. 1 for trenchless revenue in the United States.

Stantec comes in No. 2 overall with more than $250 million and is also second in U.S. revenue. WSP USA comes in third overall and reports $66.4 million for trenchless revenue in Canada, the most for 2024. Rounding out the top 5 are No. 4 AECOM ($134.5 million) and No. 5 CDM Smith ($127 million). Rounding out the Top 10 are No. 6 GHD ($101.8 million); No. 7 Black & Veatch ($71.2 million); No. 8 Hazen and Sawyer ($68.7 million); No. 9 KCI Holdings, Inc. ($57.3 million); and Delve Underground ($53.4 million) at No. 10.

WSP USA Inc. reported $500,000 in trenchless design work in Mexico for 2024. WSP is the only firm on the Top 50 to report trenchless revenue from Mexico for the second consecutive year.

There were four 100% trenchless firms to make the Top 50: Kilduff Underground Engineering, Inc.; BlueFox Engineering; J.D. Hair & Associates; and Staheli Trenchless Consultants. Kleinfelder continues a notable leap up the list as it moves to No. 20 after ranking. It was No. 32 two years ago.

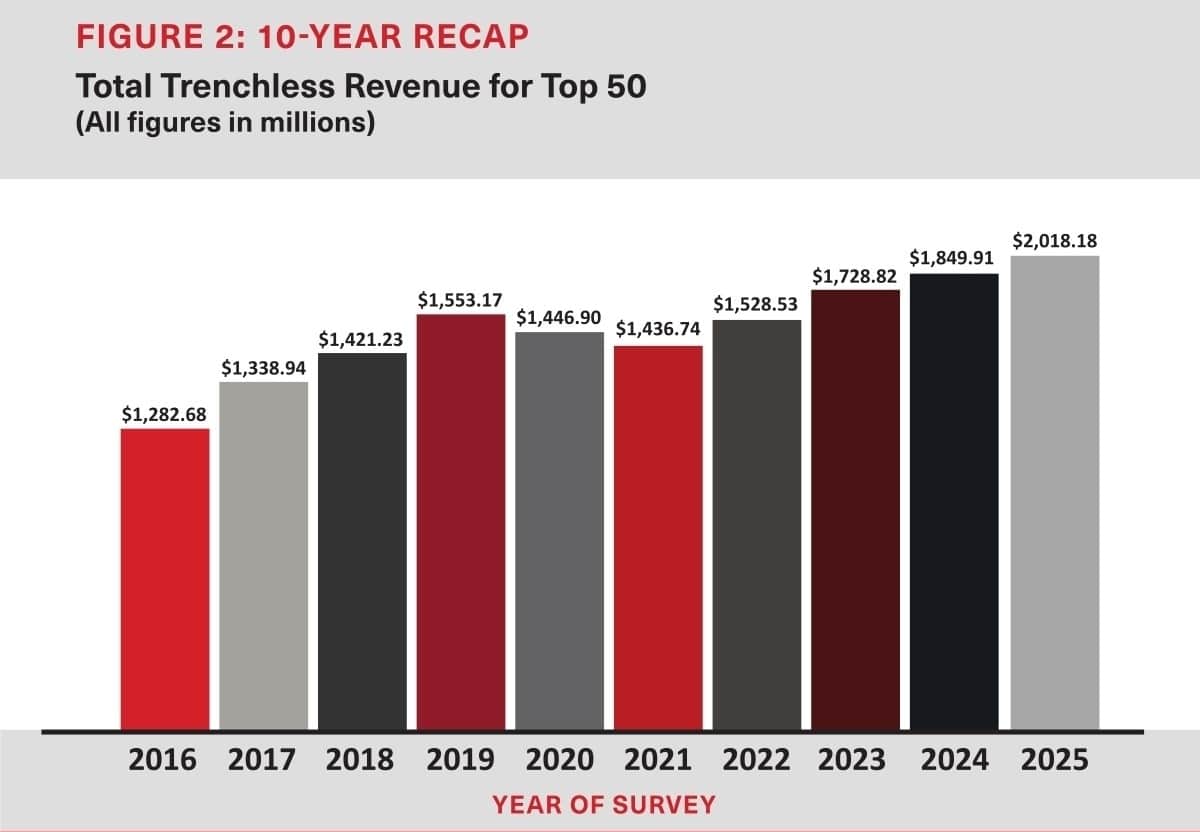

The 2025 Top 50 Trenchless Engineering Firms collectively reported just over $2 billion in trenchless design revenue.

Surpassing $2 Billion in 2025

This is the first time the top 50 has eclipsed the $2 billion mark for total trenchless revenue. It’s a 9% increase over the Top 50’s total in 2024. It’s also the first time a No. 1 firm on the list has reported more than $300 million in trenchless revenue.

Still, trenchless work comprises a small percentage of these companies’ work. The Top 50 did nearly $51.5 billion in total company revenue. Of that, 3.9% was trenchless. There are 28 companies in the Top 50 that report less than $20 million in trenchless revenue, as the big firms hold a significant market share. The top six firms this year each report more than $100 million in trenchless revenue. Together, those firms’ trenchless revenue represents 54% of the entire top 50.

Variables influence survey results year over year. This year’s figures show a continuing positive trend in the market when looking at the past several years. Figure 2 shows the 10-year curve.

On the workforce front, this year’s survey revealed more than 6,014 professionals specializing in trenchless design among the Top 50, another increase over 2024.

“In trenchless, we’re seeing continued expansion in method capabilities — such as a new HDD distance record exceeding 17,000 ft and a North American microtunneling record of over 4,900 ft,” says Paul Nicholas, vice president and market sector manager for tunneling and trenchless technology at No. 4-ranked AECOM. “In tunneling, the line between conventional TBM and microtunneling is blurring, with microtunneling diameters now exceeding 13 ft and hybrid systems emerging that begin with pipe jacking and transition to segmental lining for extended drives.”

Trenchless Projects

In addition to revenue, Trenchless Technology collects information about trenchless projects completed by the Top 50 in their reported fiscal year.

The project breakdown by method – as seen in Figure 1 above – comes from the respondents. The firms provide project totals for each discipline. This includes total linear feet for both the Pipeline Rehabilitation and Pipeline Evaluation Studies categories. Project totals are rough estimates. Some firms disclose that while they track which projects are trenchless, they do not track by specific discipline or method.

In looking at the projects tallied on this year’s survey, horizontal directional drilling (HDD) remains a top industry discipline with more than 6,917 projects reported. In the auger boring category, 712 projects were reported, along with microtunneling (509), guided boring/pilot tube (247), non-jack method projects (127), pipe bursting/slitting (118), Direct Pipe (117) and pipe ramming (110). Utility tunneling, which is defined on the survey as work for 10-ft diameter or less, reported more than 342 projects.

For pipeline rehabilitation, which includes water, storm, sewer, oil and gas, etc., the Top 50 reported more than 12,222,627 lf, a slight increase over last year. For Pipeline Evaluation Studies – also including water, storm, sewer, oil and gas, etc. – the Top 50 reported more than 62,480,241 lf completed – an increase over our 2024 survey figures.

Firms working in subsurface utility engineering (SUE) report more than 8,790 projects among the Top 50.

Innovation Pushing Design Forward

Several projects completed by engineering companies exemplify some of the innovative engineering across the industry.

South Santa Rose County

For more than 20 years, CH2M, now Jacobs, has been involved with planning and design on a regional water reuse program for utilities in South Santa Rosa County, Florida. Once completed, the overall program will eliminate an effluent discharge to the Santa Rosa sound and provide wet weather beneficial reuse for its partnering utilities.

Jacobs was contracted to provide design and construction services for Phase 1 of the program. This phase included installation of approximately five miles of reclaimed water main, a portion of which was required to cross Pensacola East Bay. The roughly 4,200-ft subaqueous crossing was designed to be installed via HDD was completed by L&K Contracting in partnership with Mears and Underground Solutions. The full process was completed in roughly 30 days.

New York City

In New York, Kilduff Underground Engineering performed pre-construction engineering designs for the tunnels for a new 30-in. fuel line approximately 1.5 miles in length that ran under the runways and taxiways of LaGuardia Airport. The challenging project involved working around airport logistics and encountering difficult ground conditions. This project initially required four microtunnels that were 54 in. in diameter ranging from 500 to 750 lf. The contractor and KUE later modified one of the microtunnels to a down-the-hole hammer system to address cobbles and boulders and performed geotechnical instrumentation and monitoring of all the tunnels.

“Both new installation and rehabilitation have changed very rapidly within the last year and especially over the past five years,” says Todd Kilduff, president of Kilduff Underground Engineering, the top-ranked 100% trenchless firm in the Top 50 this year.

“The new installation side has always been about going larger and longer for the main methods, but now we have down-the-hole hammers, retractable microtunneling systems, and microtunneling machines that can now jack fusible PVC,” he says. “None of these innovations are widely used in the U.S., but I believe that will soon change – there is just too much value in them not to.

“On the rehabilitation side we have seen new innovations in the U.S., such as spiral wound lining systems that robotically line the interior of a sewer,” Kilduff adds. “But what stands out to me are all the additional options for relining and rehabilitating existing conduits. Twenty years ago, a No-Dig Show was predominantly new installation with only a few rehabilitation methods on display. Today, No-Dig Shows are loaded with CIPP, spray-on, sliplining, mechanical liners and pipe bursting methods.”

Participating in the Top 50 Trenchless Engineering Survey

Submittals from engineering companies are imperative to making Trenchless Technology’s Top 50 ranking as comprehensive as possible. If you are a trenchless engineering company and would like to participate, please reach out to Andrew Farr at afarr@benjaminmedia.com.

Andrew Farr is a contributing editor for Trenchless Technology.

- How to Apply ASCE MOP 145 to Gravity Lining Projects

- How to Prepare and Trowel-Apply for a Manhole Rehab Project

- Melfred Borzall’s Tri-Con™ System: Faster Changeovers. Stronger Connections. Built for the Realities of HDD.

- Engineered HDPE Solutions for Trenchless & HDD Projects

- Microtunneling Short Course Owner Scholarship Program now Open

Next Up

2026 Microtunneling Short Course | May 5-7, 2026 | Scottsdale, Arizona | Learn more