Trenchless Technology’s 2022 Top 50 Engineering Firms Survey Reveals Positive Trend for the Market

In the United States alone, there are about 2.2 million miles of drinking water pipe in the ground. On the wastewater side, it’s about 800,000 miles of collection systems and 500,000 miles of private lateral sewers, these numbers all courtesy of the American Society of Civil Engineers.

Even with the vast amount of infrastructure beneath our feet, engineering plays a critical role in repairing and replacing every inch. Together with their clients, engineers work to design projects with precision, reduce risk and address a variety of jobsite challenges and conditions.

Examining some of the work done by top trenchless engineers can also offer insight into the strength of the market. That is the goal of Trenchless Technology’s December issue, which frequently examines trenchless engineering in North America, the centerpiece of which is our annual ranking of the Top 50 Trenchless Engineering Firms.

Trenchless Technology’s Top 50 Engineering Firms Survey ranking, now in its 27th year, is compiled from revenue and project data submitted by engineering companies via a survey. Trenchless Technology would like to thank all participating engineering firms for their thorough review of these figures and for working with our staff to make sure the information submitted is accurate and consistent. Only revenue figures submitted to Trenchless Technology were used to compile this ranking.

The Survey & Highlights

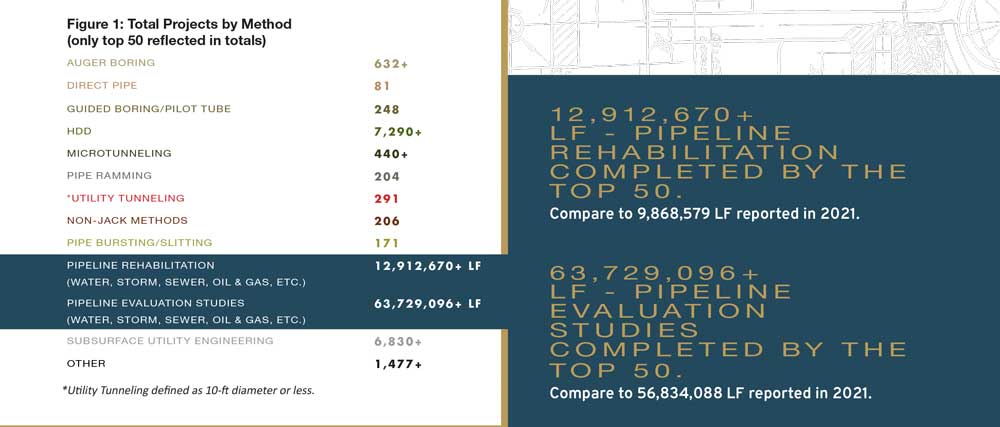

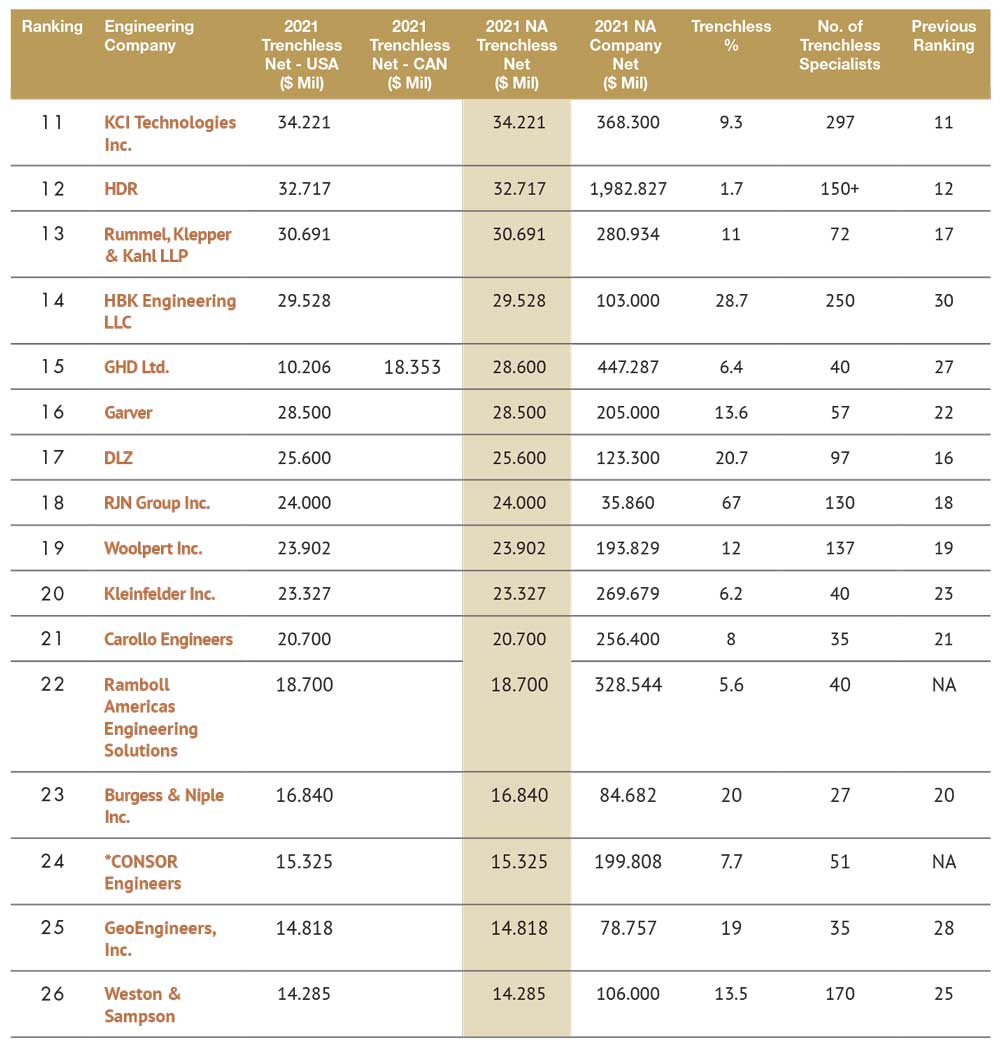

The Top 50 are ranked by North American trenchless revenue in 2021 or the company’s last fiscal year, shown in the third column: 2021 NA Trenchless Net. “Trenchless revenue” on the survey is defined as the net revenue generated by a firm from trenchless professional services including design, construction oversight and inspection using the new installation or rehabilitation methods shown in Figure 1. We again asked for revenue figures broken out by country and received figures for trenchless work in the United States and Canada, which are shown in the first two columns of the ranking.

Stantec takes the top spot in this year’s survey, reporting more than $220 million in trenchless revenue. Stantec also reports the most revenue for trenchless work in Canada at more than $78 million. Dallas, Texas-based Jacobs, ranked No. 2 in North American revenue ($217 million), has the most revenue for U.S. work ($188+ million).

RELATED: The 2021 Top 50 Trenchless Engineering Firms in North America

AECOM, consistently the largest firm in terms of total company revenue, comes in third with $125 million in trenchless work. At No. 4. is CDM Smith, $105 million, and WSP at No. 5 with $82 million in trenchless revenue. WSP also makes the biggest increase, reporting about $60 million more in North American trenchless revenue from a year ago.

Black & Veatch comes in at No. 6 with more than $70 million in trenchless revenue. CCI is at No. 7 with more than $53 million. T2 Utility Engineers ($52.4 million) ranks No. 8 and again is the highest-ranked 100 percent trenchless firm and one of four 100 percent trenchless companies to make the Top 50 this year (the others being Kilduff Underground Engineering, CNA Consulting Engineers and Staheli Trenchless Consultants).

Rounding out the top 10 are McMillen Jacobs Associates at No. 9, $45 million and Brown and Caldwell at No. 10, with $36 million in reported trenchless revenue.

Analyzing the Results

Looking specifically at trenchless revenue in North America, this year’s Top 50 firms did more than $1.528 billion in trenchless design work, an increase from $1.436 billion a year ago. Together, the Top 50 did more than $37.4 billion in total revenue. Of that, 4.1 percent was in trenchless design. On the workforce front, this year’s survey revealed more than 4,900 professionals specializing in trenchless design among the Top 50, also a slight increase over 2021.

“The trenchless market outlook is positive, and the industry continues to be healthy, driven by engineering innovation and technology advances,” says Anil Dean, P.E., P.Eng., vice president of tunneling and trenchless for Stantec, the No. 1 ranked firm in 2022. “At the same time, like most industries, ours is working through challenges including post-COVID labor and supply chain shortages, increasing construction costs, and higher inflation and interest rates.”

RELATED: 2021 Trenchless Q&A: A Look at Trenchless Engineering in Canada

The 2022 survey figures show stability in the trenchless market. The cumulative trenchless revenue among the top 50 is closer to the 2019 total after seeing a 7.5 percent decrease in the past two years (see Figure 2 showing 10-year recap). While the dip could be pandemic-related, other variables can influence survey results. Nevertheless, the uptick is a positive sign for the industry, and it will be interesting to see where things stand a year from now especially as we consider the impact of increased federal funding on underground infrastructure work.

“Despite the challenges, projects to shore up resilience are becoming a bigger priority – whether its due to climate change, aging infrastructure or population growth,” adds Dean. “Communities are increasingly allocating capital for critically needed underground assets to address demand and add redundancy and flexibility to their systems.”

Projects are also expanding in size, scope and acceptance.

Since 2013, the City of Richmond, Virginia, has completed more than $70 million of sewer rehabilitation work. Jacobs, which takes the top spot this year for U.S. trenchless work, has provided program and construction management services to Richmond for more than 15 years. The program has completed an average of 11 miles of sewer condition assessments annually, as well as a total of more than 62 miles of structural CIPP rehabilitation of the city’s 8- to 72-in. diameter gravity sewer infrastructure. It’s just one of many examples of the extensive trenchless programs municipalities are taking on.

Trenchless Projects

Speaking of projects, Trenchless Technology collects information about trenchless projects completed by the top 50 engineering firms. The project breakdown by method is shown in Figure 1.

Firms were asked to provide project totals for each discipline, counting new installation projects with multiple bores, drives or crossings as one project. Companies were asked to provide total linear feet for both the Pipeline Rehabilitation and Pipeline Evaluation Studies categories – the second year we have collected this data.

Project totals should still be viewed as rough estimates. Some firms disclose to Trenchless Technology that while they track which projects are trenchless, they do not track by specific discipline or method.

Participating in Trenchless Technology’s Top 50 Survey

Submittals from engineering companies are imperative to making Trenchless Technology’s Top 50 ranking as comprehensive as possible. If you are a trenchless engineering company and would like to learn more about how to participate, contact Andrew Farr at afarr@benjaminmedia.com.