Sizing up the Pressure Pipe Rehab Market

Pressure pipes are a critical component of any community’s daily life — both residential and commercial. And there are thousands upon thousands of miles of underground drinking water and wastewater mains across North America that are not living their best lives. They are aging, deteriorating and are in dire need of an upgrade, either by replacement or trenchless repair.

How does the trenchless industry feel about this market segment and how it fits into the future of the trenchless rehab sector?

We asked a several manufacturers that play key roles in the trenchless pressure pipe market for their perspective and insight into what’s working and not working as these pipes continue to get older and need specific attention. What does the future hold for them?

Taking part on our panel are these pressure pipe experts:

- Timmy Tipton, Technical Director, ISCO Industries Inc.

- David Kozman, P.E., Senior Product Engineer, HammerHead Trenchless

- Robert Moorhead, Executive Vice President and Chief Commercial Officer, Azuria Water Solutions

- John Moody, Director of Sales, North America, Primus Line

How would you describe today’s pressure pipe rehabilitation market — what is the good, the bad and ugly?

John Moody: With industrial vs. municipal, we see applications in the industrial sector with O&G as well as fire mains, the other two are municipal water and sewer force mains. The Good: There are plenty of emerging technologies that are being developed and entering the market, this includes CCTV, smart pigs, drones and cleaning technologies. Theses advancements are helping pipe owners and consulting engineers to approach these projects with an actual program for pressure pipe rehabilitation. Cured-in-place pipe (CIPP) technology and pull in place technology is being utilized with varying degrees of success. There seem to be three or four proven pressure pipe CIPP rehab technologies that work consistently and the best give a minimum 150 psi rating. There are plenty of technologies that are sliplining and don’t require curing of any kind. Pipe condition assessment is a critical step most don’t want to take, however, it’s a necessary first step, however due to the cost of shutting down the network and taking a look inside the pipe it’s always preferred to do it all at once. Owners are realizing there are significant cost savings associated with the former. The Bad: The adaptation of a mindset for gravity pipe repair utilizing a known rehabilitation technology isn’t always transferable and does not neatly cross over to the pressure pipe market. Connections and bends remain a challenge to overcome in the field. The Ugly: If a pipe fails a pressure test there are limited options to repair that line. Digging up the pipe can result in massive cost. The consequence of failure can be quite high!

David Kozman: Depending on the technology or market segment, it can be considered established, emerging or evolving. Non-disruptive methods to pressure pipe repair have been used in practice for nearly a century, with cement mortar lining (CML) first utilized in the early 1930s followed by the introduction of traditional sliplining in the 1940s. Explosive growth of CIPP worldwide in the gravity sewer market in the 1980s-90s resulted in its natural transition into pressure pipe applications along with the subsequent development of polymer coatings and linings, pipe bursting, close fit liners and carbon fiber reinforced polymers (CFRP) throughout the 1980s-2000s, and most recently flexible fiber reinforced pipe (FFRP). There are a lot of pressure pipelining options to choose from, each with their own unique benefits and limitations. Through ongoing collaboration, research and standards development, the industry is assessing how each technology fits from an overall design and performance perspective. Standard design methods for each lining technology grouping are at various stages of development. Once established, these design procedures will enhance existing standards and specifications and help to drive broader acceptance and market expansion.

Robert Moorhead: While rehabilitation of pressurized wastewater pipelines continues to increase, we’re also seeing an increase in rehabilitating potable water pipelines. The primary challenge with pressurized pipelines – accessing the pipe – remains the main hurdle to full trenchless rehab adoption. That said, new products and technologies continue to boost the economic argument for trenchless technology as the long-term solution for pressured pipelines. Similar to how gravity pipeline rehab became a standard method, we expect to see the same with pressurized pipes in the coming years.

Timmy Tipton: The Good: The pressure pipe rehabilitation market offers a plethora of innovative piping solutions, catering to diverse needs and challenges. These solutions often incorporate cutting-edge technology and materials, promising enhanced efficiency and longevity. The Bad: Despite the array of solutions available, there remains a significant deficit in trenchless capacity compared to the pressing demand posed by aging infrastructure. This imbalance raises concerns about the industry’s ability to adequately address the rehabilitation needs of deteriorating pipelines, potentially leading to prolonged service disruptions and increased costs for stakeholders. The Ugly: A critical issue plaguing the market is the alarmingly protracted replacement cycles observed in many municipalities, stretching from two to 500 years. This extensive timeframe underscores a concerning lack of investment in piping infrastructure, jeopardizing the resilience and reliability of essential utility networks. Urgent attention and increased funding are imperative to mitigate the risks associated with this neglect and ensure the long-term viability of vital infrastructure systems.

How would you describe the state of the pressure pipes in North America — what are the biggest concerns?

JM: Simply put, they are over their service life and are failing for a variety of reasons, such as external corrosion, ground movement and axial forces internally scour and abrasion, Ph to name a few.

DK: The biggest challenges are with availability of funding, prioritization of projects and available resources. In many cases, the host pipe condition, size and alignment are unknown until the pipe is decommissioned during construction. This can lead to unexpected delays, additional costs, a change in scope or overall approach to the project. If a municipality manages its assets based on a 50-year life cycle, a minimum of 2 percent of pipelines in its inventory should be addressed annually. This requires careful planning and an assessment program to prioritize needs in a proactive manner. Although a multitude of solutions may be identified for a project, a reduced or mixed scope and/or lack of experienced contractors can inflate costs and ultimately eliminate some pressure pipe rehabilitation systems from consideration.

RM: Like gravity pipelines, pressure pipes have had different effectiveness and life expectancy. So, factors such as geography, when pipes were originally installed and pipeline type (e.g. steel, PCCP, etc.) result in different states of remaining useful lifetimes.

TT: The state of pressure pipes in North America is characterized by aging infrastructure and widespread leakage, spanning water, sewer and gas networks. These issues pose significant concerns, impacting public health, safety and the environment while exerting economic strain on municipalities and utility providers. Addressing these challenges requires substantial investments in infrastructure renewal and proactive maintenance to mitigate the risk of escalating failures and ensure the resilience of essential utility networks.

What are the key drivers of this market — either serving as a positive for the market or a detriment for the market?

JM: Critical infrastructure failing at an exponential rate. Just at Primus Line Inc., we have seen a massive influx for feasibility inquiries with our technology.

DK: Pipeline rehabilitation solutions are systems technologies. Specifically, they incorporate products or processes which are established by a set of components, designed to fulfill a particular function, combined through precision operations, and applied using standard operating procedures. The importance of maintaining a high-quality standard for lining systems cannot be overstated, especially for pressure pipe applications. This requires designers to establish pre-qualification guidelines, performance criteria, inspection protocol and acceptance testing for design validation on each project. Testing of installed liners is only a fraction of the overall project cost; this minimal yet necessary investment verifies performance of the systems technology and encourages its use on future pressure pipe projects.

RM: As an industry, we need to continue educating the owner and engineering communities on their options. With the recent increases in funding, it’s a critical time to help municipalities take advantage of the opportunities to renew pipeline infrastructure. In reality, not every city understands how to access funding and maximize their spend, so it’s incumbent on our industry to be more active, promoting the benefits of our technologies.

TT: The key drivers of the pressure pipe rehabilitation market hinge largely on government spending. While government investment can serve as a positive catalyst, stimulating growth and innovation within the market, inadequate or inconsistent funding may prove detrimental, hindering progress and exacerbating infrastructure challenges. Therefore, the level and consistency of government spending play a pivotal role in shaping the trajectory of the market, influencing its capacity to address pressing infrastructure needs effectively.

What have been a few of the critical technological advancements this market sector has experienced over the last five to 10 years?

JM: Pipe condition assessment and consulting engineers understanding the value of implementing this in a program of rehabilitation. Organizations such as NASSCO, ISO and ASTM all are addressing the standards and methods for rehabilitation, as well.

DK: From a product and systems development perspective, there have been improvements and advancements in CIPP resin and liner technologies, specifically as it relates to end use applications, formulations, pot life, curing methods, textile composition and installation techniques. The industry has also benefited from an expansion of spray in place (SIPP) product offerings and capabilities, and the introduction of FFRP technology, amongst others. From an industry standpoint, there’s been an increased emphasis on standards development related to pipeline assessment, lining technologies, structural classifications, and design. Industry association committee activities are ongoing and active within AWWA, ISO, ASTM, ASME and NASSCO, with several standards and publications issued in recent years. On the water side, AWWA has been the most active, with the release of manual of practice (MOP) M77 on condition assessment and the structural classifications committee report, which is complemented by recently published standards C305 (CFRP), C620 (SIPP), C622 (pipe bursting) and C623 (CIPP). In addition, design appendices to accommodate these standards, as well as the new MOP M81 and an update to MOP M28 for worker and non-worker entry water main rehabilitation, respectively, are in development. For sewer force mains, NASSCO provides good guidance, resources and education on pressure pipelining and have recently incorporated coding specific to pressure pipe assessment in PACP version 8.

RM: The industry has seen a number of advancements in materials used in pipe liners, spray-on applications and resin systems. Many of these advancements have accelerated the use of trenchless solutions for pressure pipes, especially potable water. Concurrently, new technologies have opened doors for new careers and kept some of our best people in the industry.

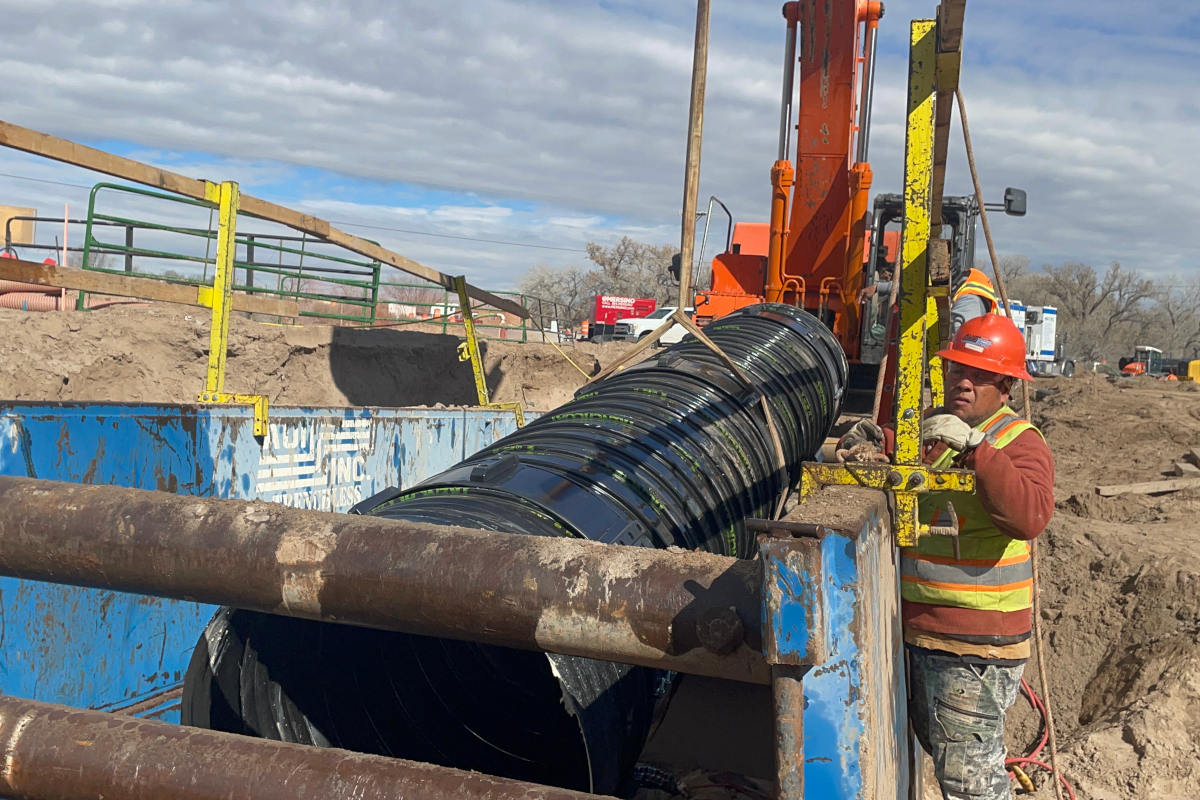

TT: In the past five to 10 years, the pressure pipe rehabilitation market has witnessed several critical technological advancements, with a notable trend being the increased utilization of high-density polyethylene (HDPE). This material offers numerous benefits, including enhanced durability and flexibility, driving significant reductions in public disruptions during installation. Moreover, the introduction of HDPE products boasting stress life spans exceeding 100 years represents a substantial leap forward in pipeline longevity and reliability. These advancements not only improve the efficiency of rehabilitation projects but also contribute to the overall resilience and sustainability of pressure pipe infrastructure.

Crystal ball: How do you see this market sector making an impact in the trenchless industry in the short- and long-term?

JM: It’s the future of the industry.

DK: The market potential is tremendous as we have only just scratched the surface. History indicates that market maturation and growth correlates directly with standards development, educational outreach, technology acceptance and overall cost benefits. This reflects recent trends over the last five to 10 years, with the pressure pipe market trending upward and projects increasing in size and frequency throughout North America.

RM: We expect not only will the economic benefits of trenchless continue to advance but the recognition of lessened environmental impacts as well. As communities focus more on sustainable practices, the trenchless industry is well positioned to lead the charge.

TT: Looking ahead, the pressure pipe rehabilitation market is poised to exert a transformative impact on the trenchless industry both in the short and long term. In the short term, we anticipate a rapid expansion in the installation of pipelines, facilitated by advanced technologies and methodologies. This acceleration in installation pace is expected to yield immediate benefits, including minimized disruptions to the public and expedited project timelines. In the long term, the focus will shift towards optimizing service life and sustainability, with a growing emphasis on deploying durable materials and innovative techniques to ensure the longevity and reliability of pressure pipe networks. By prioritizing long-term resilience and efficiency, the market sector is positioned to catalyze substantial advancements within the trenchless industry, shaping its trajectory towards enhanced performance and sustainability.

Sharon M. Bueno is editor of Trenchless Technology.