Unprecedented Federal, State Infrastructure Investment Bodes Well for Nation’s Water and Sewer Assets

This year marks the 50th anniversary of the Clean Water Act, which has generated a legacy of improved water quality in our rivers and lakes and healthier drinking water sources while creating significant fiscal challenges for many communities in removing hazardous materials from drinking water and meeting long-term pollution control obligations.

The American Rescue Plan (ARPA) and Infrastructure Investment and Jobs (IIJA) Acts will increase federal investments in water and sewer systems to unprecedented levels over the next several years, providing potential economic relief to thousands of communities across the nation facing compliance challenges.

While the COVID-19 pandemic has negatively impacted communities worldwide, it has also led to significant public investment in infrastructure and economic recovery.

Where Can ARPA Funding Go?

ARPA provided $350 billion in financial assistance allocated to every state, local government, and federally recognized tribe and territory in the United States, with water and sewer projects among the few unambiguous eligible uses. Project planning, design, and capital improvement projects are all eligible to use ARPA funding.

Recently, the United States Treasury issued its Final Rule on ARPA expenditures. While the Rule expanded the eligible uses for water and sewer projects to include stormwater improvements and dam removal, the news was not all good for water sector investment.

The Rule also greatly expanded eligible uses in other areas, notably creating a $10 million “standard exemption,” which enables smaller units of government to spend ARPA funding on a much wider array of government services. This means that governments that had been more likely to spend on water and sewer projects can now spend their ARPA funding on roads, bridges and other capital investments.

For communities facing affordability issues, the funding can be used to help address delinquent payment and water access issues. The ARPA Final Rule includes a framework to identify negatively affected groups — such as neighborhoods, homeowners and businesses — and develop programs that address those impacts.

RELATED: Last Word – Engineers Must Avoid Bottlenecks That Could Delay Infrastructure Funds

ARPA also provided direct financial assistance to states, which in many states is manifesting in new grant programs for water and sewer. In Florida, the state legislature moved quickly to establish a new wastewater grant program and fund the Resilient Florida program, which launched many water and sewer projects. Ohio has already used $250 million of its allocation for a quick round of wastewater grants and may include additional rounds in this year’s capital budget.

States are also considering how to spend higher than anticipated general fund revenue this year. Although COVID-19 lowered revenue expectations in 2020 and 2021, most states are experiencing multi-billion-dollar surpluses, as well as increased projections over the next few years. This has led to ambitious proposals, such as a $3-billion measure in the State of Michigan for water, sewer and dam projects.

Looking at IIJA

We also finally celebrated the much-anticipated Infrastructure Week in 2021 with the passage of the IIJA. Combined with the ARPA, it may be more apt to say we are in an “Infrastructure Decade.”

Widely perceived as a stimulus program, the IIJA sets the stage for sustained spending and a stronger federal role in financing water and sewer infrastructure investment over the next decade.

While “shovel-ready” is a familiar buzzword in the industry, the IIJA has a different focus as policy-makers seek “shovel-worthy” projects. Funding will remain competitive and project owners that plan and design projects to meet policy priorities will be positioned to succeed in the coming years.

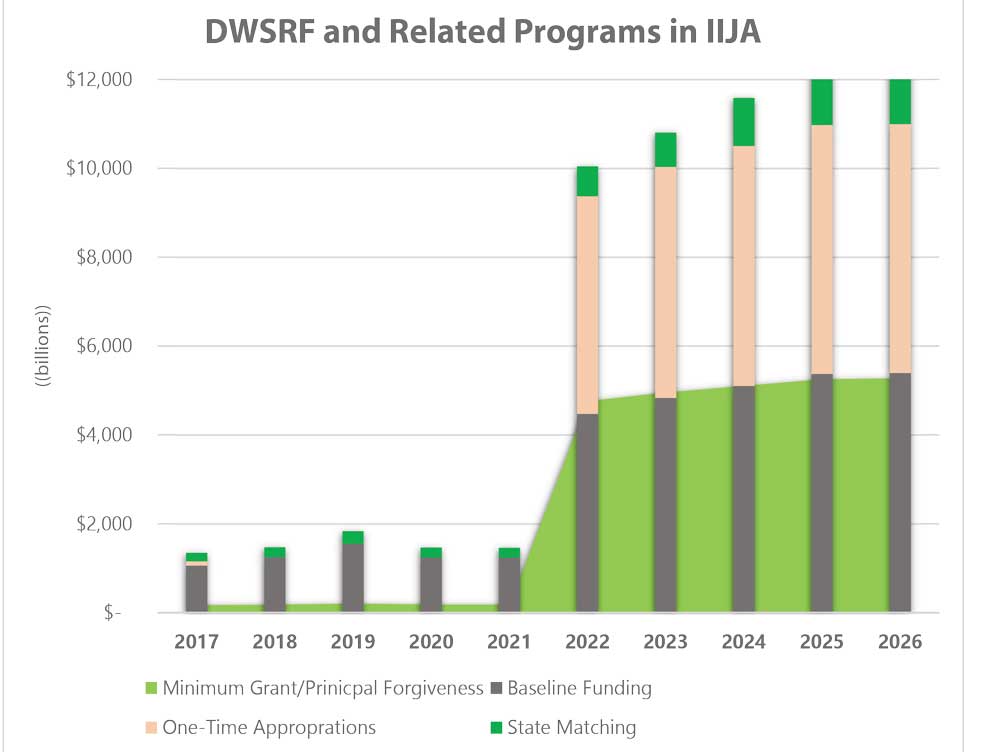

The most significant increase for water and sewer funding in the IIJA is for existing State Revolving Loan (SRF) funds through the Environmental Protection Agency. The SRF funds for sewer and wastewater treatment projects will see nearly a four-fold increase in federal capitalization over five years. On the drinking water side, the funds will have more than eight times the funding over the previous half-decade, including significant set-asides for removing lead, PFAS and other contaminants from water supplies.

Removal of lead water mains and service lines is a major initiative of the IIJA, with $15 billion dedicated to that effort.

Although this provides an excellent opportunity to remove critical public health hazards from homes and neighborhoods, the industry will be challenged with identifying and replacing lines efficiently. This provides an opportunity for innovation from the trenchless industry to mitigate labor shortages and disruptions of such infrastructure work.

The IIJA also includes additional funding for the existing Sewer Overflow and Stormwater Reuse Municipal Grants program, which will allocate $1 billion among the states over the next five years.

The need in communities facing sewer and stormwater overflow challenges far exceeds that funding and the industry continues to advocate for increases. However, the limited amount of funding makes this program a good fit with trenchless system fixes like inflow/infiltration initiatives as opposed to large-scale storage projects.

With many SRF program characteristics decided at the state level, the increased levels of investment provide the potential for policy changes that better utilize available resources.

RELATED: Last Word – Unprecedented Infrastructure Investment

For instance, Ohio and Florida currently limit additional subsidies in the form of principal forgiveness and grants to communities less than 10,000 in population. With expanded resources, policy changes to improve system sustainability and user affordability for urban communities may be on the table.

Two popular programs that were not included in the IIJA are the Department of Agriculture’s Rural Development Water and Waste Programs. Despite not receiving increases in the IIJA, these remain a potent tool for rural areas to develop new water and sewer service or maintain their existing systems, offering competitive interest rates, long-term loan terms, and grant subsidies for economically challenged communities.

Despite the promise of ARPA, IIJA, and increased state revenues, water and sewer system owners must continue to take a balanced approach to funding and financing projects. Sustainable federal infrastructure investment beyond the coming decade is not assured.

With private-sector interest in conservation and environmental stewardship increasing, the industry is learning how to better incorporate equity and philanthropic investment in the water and sewer sector. However, ARPA and IIJA provide a historic opportunity to position the nation’s water and sewer assets to thrive.

Editor’s Note: This story is the first of a three-part series from Wade Trim that focuses on infrastructure funding. In our April issue Wade Trim will focus on funding that relates to water distribution and sewer rehab and in our May issue they will focus on funding relating to tunnel and shaft work.

Wayne Hofmann is a client funding manager at Wade Trim.