What’s on the Horizon for Lead Service Line Replacement?

Lead is back under the microscope in the U.S. water sector. Although it has become a public health and infrastructure priority, lead service line replacement can be a challenging, costly and time-consuming endeavor for municipalities.

Since the water crisis in Flint, Michigan began in 2014, lead has been a hot-button issue for drinking water utilities. Flint’s water was tainted with lead for at least 18 months. While under the control of state-appointed financial managers, the city tapped the Flint River as its water source while a new pipeline was being built to Lake Huron. But the river water wasn’t treated to reduce corrosion, and as a result, lead leached from old pipes and fixtures and contaminated the water distribution system with unsafe levels.

The incident sparked intense discussion and focus within the water sector about how to tackle the challenge of lead pipes in the ground, given the risks if a distribution becomes contaminated. By 2016, the American Water Works Association (AWWA) supported recommendations from the National Drinking Water Advisory Council (NDWAC) to strengthen the Lead and Copper Rule (LCR) to ultimately lead to the complete removal of lead service lines.

RELATED: Sewer Rehabilitation, Lead Replacement Poised to Thrive with Increased Funding and Creativity

“The Flint crisis lays bare a simple fact: As long as there are lead pipes in the ground or lead plumbing in homes, some risk remains,” AWWA CEO David LaFrance said at the time. “As a society, we should seize this moment of increased awareness about lead risks to develop solutions for getting the lead out.”

Lead is unlike other potential contaminants in that it is rarely present in the water coming from treatment plants and water mains; rather it primarily comes from lead service lines and home plumbing. Under the Lead and Copper Rule, utilities collect samples from homes thought to be at high risk for lead. They use results from those samples to indicate if the utility should adjust water chemistry to protect against lead leaching into the water.

The U.S. Environmental Protection Agency (EPA) estimates that there are 6.3 million to 9.3 million homes across the country with lead service lines (LSLs) and millions of other buildings with lead solder and/or faucets with lead. Fortunately, the agency reports that lead action level exceedances today among large systems are 90 percent lower than they were when the Lead and Copper Rule was first introduced in 1991.

Still, the truest way to protect against lead in potable water is to remove all sources of lead. And although it has become a public health and infrastructure priority, lead service line replacement can be a challenging, costly and time-consuming endeavor for municipalities. It can also require time and collaboration with property owners, manufacturers, state regulators, federal agencies, financing authorities, plumbers, code officials, local government and many others.

Lead and Copper Rule Revisions

On Jan. 15, 2021, the EPA published its long-awaited revisions to the Lead and Copper Rule in the Federal Register. There was some expectation within the water sector that the EPA, under incoming President Joe Biden, would put the effective date of the revisions on hold, allowing Biden’s EPA time to contemplate additional changes to the LCR followed by a revision process. Instead, the revisions officially went into effect on Dec. 16, 2021, and drinking water systems will need to comply with several items by October 2024.

The rule revisions significantly advance the goal of 100 percent lead removal in a couple of ways. First, it requires water utilities of all sizes to develop inventories of lead service lines in their service areas and to share that information with their communities. Second, the rule requires water utilities to develop plans to remove all lead service lines in their entirety over time. Per the Association of Metropolitan Water Agencies (AMWA), some of the other highlights of the new requirements for drinking water systems include:

- Maintaining the 15 parts-per-billion (ppb) action level alongside a new 10 ppb trigger level, a 90th percentile exceedance of which means a water system must carry out additional planning, monitoring, and treatment activities.

- Requiring each water system to complete a LSL inventory, as well as an LSL replacement plan if lead pipes are present in the system.

- A mandate for water systems to replace LSLs at a rate of 3 percent per year (on a two-year rolling average) following an action level exceedance. This requirement is lower than the 7 percent replacement rate of the previous rule, but the new regulation bars “test-outs” and other loopholes that allowed water systems to avoid actually replacing LSLs.

- Discouraging partial LSL replacements while still allowing flexibility for water systems to carry out emergency repairs.

- A “find-and-fix” process through which water systems must evaluate the need for corrective action following the collection of any single sample with lead measured above 15 ppb.

Guidance from state regulators may vary from state to state, but the common denominator that affects all utilities is the lead service line inventory requirement.

Lead Pipe Inventory Including Private Property Side

Developing a lead service line inventory essentially involves a water utility creating of a database of all location-based service lines including those within its distribution system and on the customer side.

In the past, water systems have only been responsible for public service lines, with any side of the line on consumer property falling outside of their compliance requirements. The LCR revisions require systems to conduct a complete location-based inventory of both public and private side lines. The starting point for utilities will vary depending on the degree to which a lead inventory has already been established.

RELATED: Last Word – Lead Service Line Replacement Programs: Are We Missing an Opportunity?

Where lead service lines are present, systems will be required to update the inventory annually and develop a Lead Service Line Replacement plan to meet annual goals. When it comes to digging and replacing on the private side, whether or not the utility will eventually pick up the full cost will vary by state and municipality. However, the rule does contain the caveat that systems must replace the publicly owned side of a lead service line within 45 days of a customer replacing the private side, if the customer notifies the utility. According to AMWA, this deadline can be extended up to 180 days as long as the water system informs the state of the need for this extension.

For a utility, the challenge of collecting information to compile such a database involves aggregating multiple data types including data from tap cards, historical records, data directly from customers and third-party data such as tax parcel data. As part of the inventory, water utilities will need to classify service line materials as either lead, another material, or unknown.

“That is a monumental task,” says Megan Glover, co-founder and CEO of 120Water, a comprehensive digital water platform combining cloud-based software, professional services and sampling kits to help utilities achieve lead compliance. “There are a handful of data types that the rule says utilities need to aggregate before they can call their inventory complete. I think what we’re going to see this year as an industry is an absolute focus on utilities starting these inventories and really identifying the lead materials both on the public and private side of the service line.”

Additionally, Glover says 120Water is recommending to its customers that those inventories include not only lead service lines but also lead materials in schools and daycare facilities, which will also be expected to meet sampling requirements by 2024.

The Infrastructure Investment and Jobs Act signed last fall by President Biden delivers about $50 billion in new spending for water/wastewater projects. Included in the package is $15 billion for lead service line replacement projects and “associated activities directly connected to the identification, planning, design and replacement of lead service lines.” The funding will be appropriated evenly at $3 billion per year from FY22 through FY26. The funds will be provided to states via the DWSRF, but no state match is required, and 49 percent of funds must be awarded by states as grants or principal forgiveness loans.

Glover says financial support from the infrastructure bill will no doubt positively impact the task of lead inventory and replacement, but it will still be up to states and municipalities how the funds are used.

“I think the infrastructure bill laid out the areas where the money needs to flow for maximum impact,” she says. “Now, it’s really up to the SRF funds and the other entities deploying those funds, to ensure [utilities] are focused on the right work.”

Locating Lead Service Lines

A study published in 2016 by AWWA estimated that at least 6.1 million lead service lines remain in U.S. communities today. Reviewing records such as existing policy and plumbing codes, home age, and tax parcel data can help utilities make assumptions about the likelihood of lead on a property, but it’s still an enormous challenge. Therefore, the task of completing inventory and replacement plans invites many questions. Where do most utilities stand on the task? Do they even have some level of inventory created? Or, are they significantly behind? How will utilities locate all lead pipe materials, especially when inventory requirements now include the homeowner side?

“Overall, they are unprepared to deal with the private side inventory,” says Greg Baird, a WF&M contributor and recently-named national lead service line inventory and replacement executive director for BlueConduit, which offers a statistical model for locating lead pipe.

“At best lead records are unreliable, and at worst, it’s completely unknown and utilities are going to have to use some modeling to figure out that inventory,” Baird adds. “It’s a heavy lift.”

Predictive modeling can be a tool to generate information about private side service lines. Utilities can input existing data into a model to generate probabilities for every home with an unknown service line, helping them to prioritize and quantify the efforts needed to validate materials.

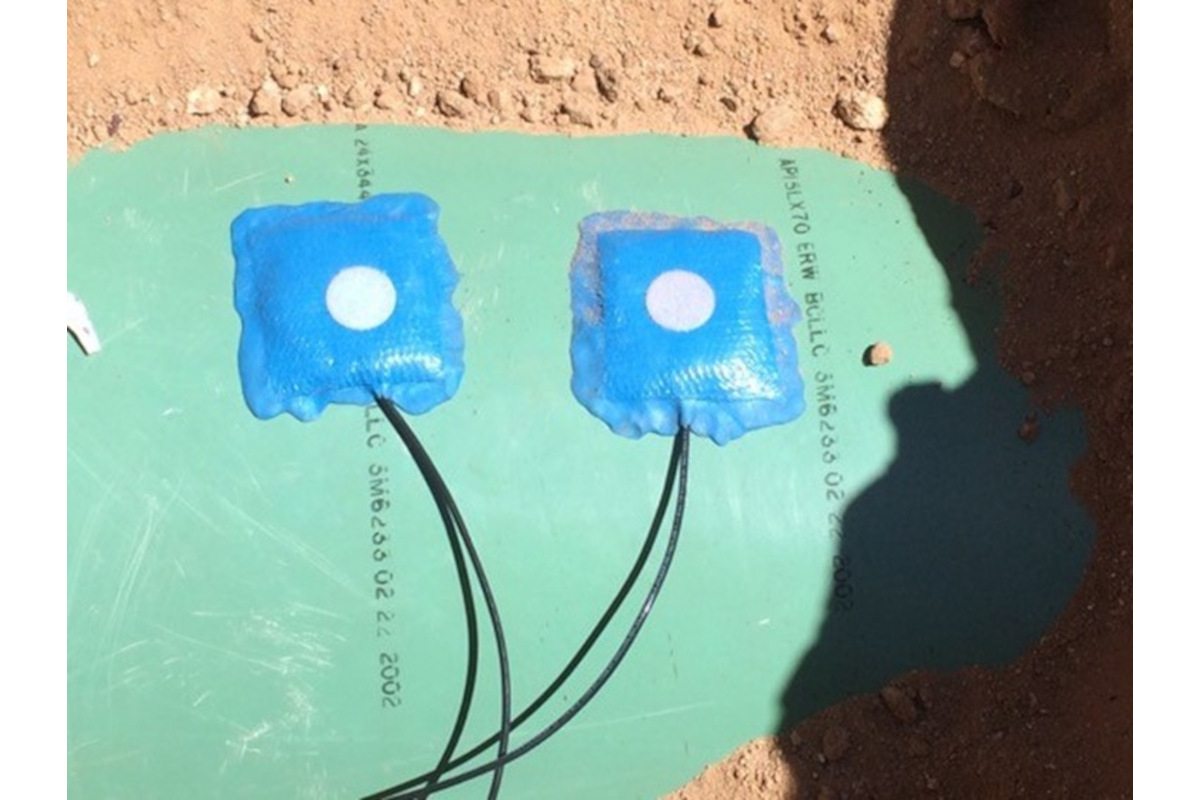

Recently, statistical models have shown to be beneficial in this endeavor. Around 2016, professors at the University of Michigan developed a statistical model that shows utilities where to dig to locate verified pipe materials – in this case, lead. Once materials are verified via inspection, the data is fed into a machine learning model. That model will then generate a high probability of the location of lead materials throughout the system including on the private side. The process was applied successfully in Flint.

According to Baird, the processes that water systems will use to budget and prioritize their replacement projects can impact total costs and carry public health risks. He says it’s not uncommon for utilities to use incomplete, inaccurate and unreliable historical records to make these decisions. It is these uncertainties, he says, that statistical modeling is focused on reducing, adding that statistical modeling allows for fast, accurate identification of lead service lines, equipping decision-makers with the information they need to plan and prioritize replacement.

RELATED: Last Word: The Water Main Report Card

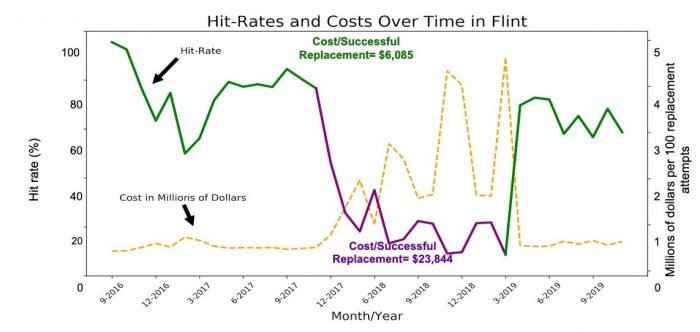

The key metric used for in-the-field evaluation of accuracy is “hit rate,” the number of lead service lines that were identified divided by the number of attempted replacements regardless of what was discovered. Hit rate can be computed for an entire region or broken down into a specific geography or time. It can also apply to any replacement project, regardless of whether it uses a predictive model. A higher accuracy hit rate reduces the number of exploratory digs.

“The inventory and the accuracy of any predictive modeling really dictates the flavor, the trust and the cost of the rest of the program, says Baird, who previously served as a water utility finance officer. “For this to be cost-effective, your model needs to have the highest accuracy possible.”

According to Baird, the estimated cost of digging up lead service lines for replacement can be in the range of $2,000 per excavation. By the figure, a city could save upwards of $50,000 by avoiding just 25 excavations. On the other hand, a statistical model can also provide location-based evidence to the state and EPA that a community does not have lead in its service area.

On the funding end, Baird agrees with Glover and says the timing of the funding included for lead service line work in the infrastructure bill will spur much of this work.

“To me, there is an integrated asset management component to this,” he says. “If you’re not integrating [LSL inventory and replacement] into your asset management and financial planning process, you’re not going to make it as cost-effective as possible.”

Communication & Restoring Trust

The new job of inventorying the private side includes the need for more communication and education between utilities and their customers. Communication has been a focus area for utilities in recent years as the internet and social media have made it easier to connect with customers and educate the public on the importance of a utility’s work beyond just sending out monthly bills.

Lead service line replacement will be no different, and experts say it will require a collaborative effort between systems and residents, with the completion of an inventory relying heavily on resident responsiveness and private-side access. WaterPIO, which provides communications services for water and wastewater systems, has expressed concern that the new LCRR compliance can reduce the response time utilities have to properly notify the press and public, noting good communication can prevent panic.

Baird warns that city leaders will need to think through the policy issues as programs are established as not to erode public trust, noting how the water industry’s reputation took a hit amid the Flint crisis. He says inventory development should be a major component of a utility’s communications strategy so that the public is accurately and properly informed about lead materials in their service area while also not raising alarm as inventories are developed and become publicly available.

“We really need to do this in a way where we’re proactively reaching out to communities and working with them,” he says. “This is our chance – with the schools, with the homeowners – to re-establish a degree of trust with water quality.”