Trenchless Technology’s Top 50 Trenchless Engineering Firms – 2023 Survey Analysis

This year, Trenchless Technology conducted its 28th survey and ranking of the Top 50 Trenchless Engineering Firms in North America, compiled from revenue and project data submitted by engineering companies.

Trenchless Technology would like to thank all participating engineering firms for their thorough review of these figures and for working with our staff to make sure the information submitted is accurate and consistent. Only revenue figures submitted to Trenchless Technology were used to compile the ranking.

Trenchless engineering continues to evolve on several fronts. Like so many aspects of the construction industry, advances in equipment and technology are propelling trenchless design to complete projects of greater complexity. Methods like cured-in-place pipe (CIPP) and sliplining are also being employed to rehabilitate larger diameters and longer sections of pipe, all thanks to innovative engineering. On the new install side, microtunneling and HDD projects feature longer, curved drives for a variety of applications.

“There are significant feats that we didn’t see 10 to 15 years ago, including more resilient fault crossings and the first large-scale offshore wind farms in the U.S. — all thanks to horizontal directional drilling,” says Anil Dean, P.E., P.Eng., MBA, vice president of tunneling and trenchless at Stantec, which ranked No. 1 for the second consecutive year. “We’re also seeing longer microtunnel drives with larger diameter jacking pipe and more elaborate curved drives.”

Here, we’ll examine some of the results from the 2023 Top 50 Trenchless Engineering Firms in North America survey and any takeaways that may offer insight into the strength of the market.

The Survey

The Top 50 Trenchless Engineering Firms are ranked by North American trenchless revenue in 2022 or the company’s last fiscal year, shown in the third column: 2022 NA Trenchless Net. Specific revenue figures are shown for trenchless work in the United States and Canada in the first two columns of the ranking. All figures are in U.S. dollars. Trenchless revenue on the survey is defined as the net revenue generated by a firm from trenchless professional services including design, construction oversight and inspection using the new installation or rehabilitation methods shown in Figure 1.

Analyzing the Top 50 Trenchless Engineering Firms Results

Stantec retains its place atop the ranking of the Top 50 Trenchless Engineering Firms, reporting more than $253 million in trenchless revenue for North America. Stantec also reports the most revenue for trenchless work in Canada at more than $75 million. Jacobs is ranked No. 2 overall at $228+ million. Rounding out the top 10 are AECOM ($126.4 million); WSP ($117.3 million); CDM Smith ($109 million); Black & Veatch ($79.2 million); T2 Utility Engineers ($56 million); Delve Underground ($55.2 million); KCI Technologies Inc. ($51.2 million); and CCI Inc. ($47.6 million).

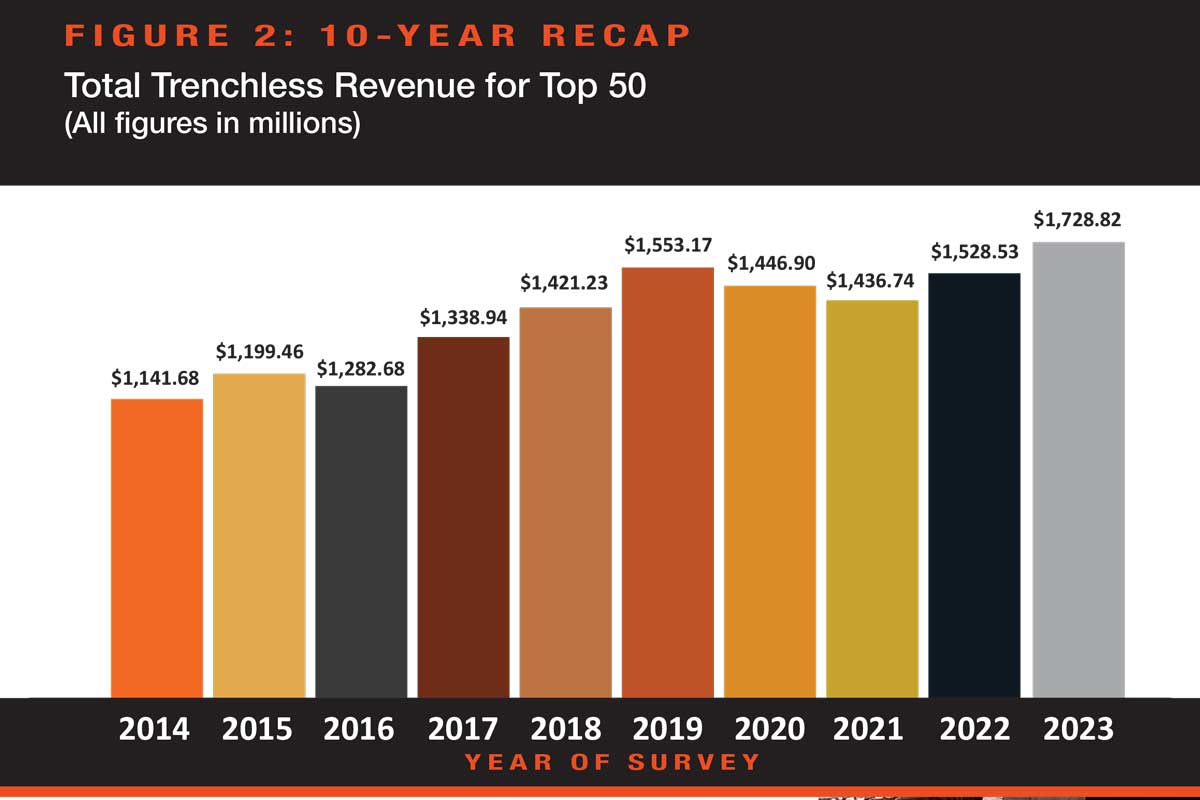

Looking at trenchless revenue in North America, this year’s Top 50 firms collectively reported more than $1.728 billion in trenchless design work, a 13.1 percent increase over the 2022 survey. Together, the Top 50 firms did nearly $56 billion in total company revenue. Of that, 3.1 percent was in trenchless design. On the workforce front, this year’s survey revealed more than 5,319 professionals specializing in trenchless design among the Top 50, an increase over 2022.

Following a couple years in which the collective top 50 revenue saw a decrease (2020-2021) – seemingly pandemic-related – the 2023 survey figures show a positive trend in the market that build on the growth reflected in the numbers prior to 2020 – see Figure 2 showing the 10-year recap. While variables influence survey results, the uptick is a positive sign for the industry.

Another finding to note is the diversity in size of engineering company to rank in the top 50. This year the Top 5 firms report more than $100 million in trenchless revenue. Together, those firms’ trenchless revenue represents 48 percent of the total top 50 trenchless revenue for 2023. Meanwhile, 20 of the top 50 firms report less than $10 million.

Read More – Top 50 Trenchless Engineering Firms in North America Archives

Projects

In addition to revenue, Trenchless Technology collects information about trenchless projects completed by the top 50. The project breakdown by method is shown in Figure 1. Firms were asked to provide project totals for each discipline, counting new installation projects with multiple bores, drives or crossings as one project. Companies were asked to provide total linear feet for both the Pipeline Rehabilitation and Pipeline Evaluation Studies categories – this is the third year we have collected this data. Project totals should be viewed as rough estimates. Some firms disclose to Trenchless Technology that while they track which projects are trenchless, they do not track by specific discipline or method.

Of the reported projects this year, more than 6,558 subsurface utility engineering projects were completed among the Top 50. Horizontal directional drilling (HDD) remains a top market discipline with more than 7,285 completed projects reported. Next is Auger Boring (636+), Microtunneling (414+), Utility Tunneling (316+), Non-Jack Methods (233+), Guided Boring/Pilot Tube (183+), Pipe Ramming (173+), Pipe Bursting/Slitting (116+) and Direct Pipe (100). For Pipeline Rehabilitation, which includes water, storm, sewer, oil and gas, etc., the Top 50 reported more than 14,998,852 lf. For Pipeline Evaluation Studies – also including water, storm, sewer, oil and gas, etc. – the Top 50 reported more than 53,910,658 lf completed.

“We’re seeing several exciting developments in the trenchless market today,” says Dean. “From advancements in instrumentation and monitoring to new and emerging technologies – think AI and plasma systems – Stantec is working to identify applications for innovative tools that will deliver exceptional projects.”

One such project with no shortage of innovation is the Trans Mountain Expansion Project (TMEP), a twinning of an existing pipeline between facilities in Edmonton, Alberta, to Westridge Marine Terminal in Burnaby, British Columbia. Stantec is supporting the TMEP in multiple capacities including overseeing construction of the trenchless crossings, geotechnical and environmental engineering services, and more. The project includes more than 65 major trenchless crossings, including a 2.6-mile hard rock tunnel, and more than 500 shorter trenchless crossings utilizing a wide range of trenchless methodologies. The crossings are being performed in diverse topographical settings ranging from prairies and deltas to mountain ranges, and geological conditions ranging from soft marine clay to extremely hard rock formations.

In the United States, Austin Water operates a 24-in. diameter reclaimed water line and a 12-in. diameter sludge transfer line in the Texas capital. Both are critical single transmission pipelines that originate at the South Austin Regional (SAR) Wastewater Treatment Plant and cross the Colorado River. Erosion along the bank of the Colorado River had exposed both ductile iron pipes. Jacobs, which ranks No. 1 in U.S. trenchless revenue on this year’s Top 50 survey, partnered with Austin Water to deliver the SAR Sludge Transfer and Reclaimed Line project to replace the pipelines with a 30-in. diameter HDPE pipe and dual 16-in. diameter HDPE pipes. The crossings of the Colorado River were by completed via HDD and included horizontal curves to remain within public property, avoiding the need for private property easements and completed with significant elevation difference between the entry and exit points.

*Lithos: In September 2023, Lithos Engineering announced it was joining GEI Consultants. This year’s submission from Lithos does not include any revenue figures from GEI.

Other Trends & Outlook

With advancements in trenchless design driving complex projects to be completed at a greater clip, it begs the question: is trenchless design for new installation and rehabilitation still considered a niche method?

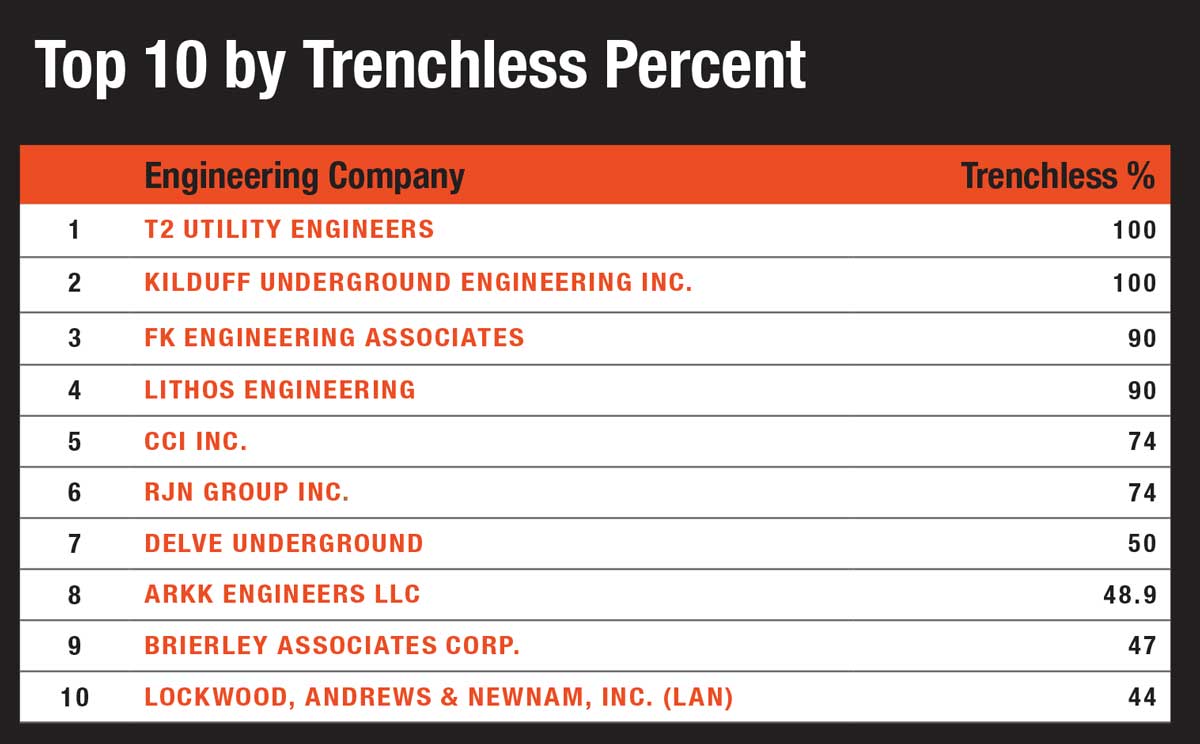

“I would say most definitely yes. Trenchless design is still very much a niche market,” says Todd Kilduff, president of Kilduff Underground Engineering, ranked 43rd and one of only two 100 percent trenchless firms to rank in the top 50 this year. “Significant progress has been made in education and making bigger cities and larger municipalities aware of what different methods and options are out there, but the vast majority of municipalities and some cities are still unaware of the available solutions.”

In addition to education, the importance of subsurface utility engineering will continue to increase to address the congestion of existing utilities and negotiations with right of way owners for trenchless projects, says Blaine Hunt, director of engineering and quality at T2 Utility Engineers, also a 100 percent trenchless firm.

“This will become increasingly complex as trenchless installations are placed deeper to avoid existing congestion,” he says. “Trenchless providers will likely be involved in providing services to tighter tolerances to secure utility agreements.

“One solution to resolving utility agreements may involve utility coordinators along with the development of reliable records which show the accurate location of newly installed utilities, providing a permanent record. The new Standards ASCE 75-22 and CSA S250 provide guidance on recording and exchanging this data to help in this process.”

Read More – Top 50 Trenchless Engineering Firms in North America Archives

Participating in the Top 50 Trenchless Engineering Firms Survey

Submittals from engineering companies are imperative to making Trenchless Technology’s Top 50 Trenchless Engineering Firms ranking as comprehensive as possible. If you are a trenchless engineering company and would like to learn more about how to participate, please contact Andrew Farr at afarr@benjaminmedia.com.

Andrew Farr is a contributing editor for Trenchless Technology.